Home

/

Samples

/

The Role Of Foreign Banks In Emerging Countries

Introduction

Banks act as a financial intermediary involved in borrowing and lending activities. It accepts deposits and savings from various entities such as general public, corporate entities etc. and uses the same in on-lending purpose through direct banking channels or capital markets.

The history of banks can be pegged back to ancient history. Initially the world traded on “BarterSystem” which had inherent flaws necessitating the development of banking system. Temples were the first banks which grew as an industry gradually and today it rules the world financial system (Giuseppe Felloni, 2004). The banking system has evolved from a small answer to flaws endured by Barter System to a fully grown industry providing various services to the country and its people. Gradually the world has evolved to 195 countries (United Nations) with own banking system. In most of the countries a Central Bank regulates the entire banking system.

In the current scenario of a globalized and liberalized world, the role of a central bank is of utmost importance. It regulates the money supply, issues currency for the govement and oversees the commercial banking system of the country.

A commercial banking system allows money to transfer from one string to other. Depositor keeps money with a bank, which utilizes the same for lending activities and in the process eaing its income through the differential of the two. The bank eas money through charging interest fees, transactional fees and advisory services.

The banking system has kept on developing from time to time and with the help of liberalization of the financial sector, restriction has been reduced by various regulatory authorities and they have allowed foreign banks and financial institutions to enter and run business in their countries. In this paper we are going to discuss various strategies adopted by foreign banks and their role in emerging markets.

Emerging Markets

Countries restructuring their economic methodology as per the market requirement and offering a wealth of opportunities for Trading, Transfer of Technology and Foreign Direct Investment are known as Emerging Markets (Li). The biggest five emerging economies are China, India, Brazil, Russia and Indonesia. Other countries that will rank below these countries are South Africa, South Korea, Mexico, Poland, Argentina and Turkey(World Bank). These countries are largely populated, have high resources and provide large markets and they are willing to go for fully convertible capital account with open door policy.

In 1990s, many of these countries saw a sort of banking crisis where there were major economic disorders, such as, rising interest rates, depreciation of currency and credit flows declining. Since then, many countries have improved their economic condition and the banking system. The capital market consisting of bond market and equity market has been better utilized.

Morgan Stanley Capital Inteational (MSCI) has classified the following 21 countries as Emerging Markets: (Morgan Stanley Capital Inteational)

|

1.

|

Brazil

|

8.

|

India

|

15.

|

Philippines

|

|

2.

|

Chile

|

9.

|

Indonesia

|

16.

|

Poland

|

|

3.

|

China

|

10.

|

Korea

|

17.

|

Russia

|

|

4.

|

Colombia

|

11.

|

Malaysia

|

18.

|

South Africa

|

|

5.

|

Czech Republic

|

12.

|

Mexico

|

19.

|

Taiwan

|

|

6.

|

Egypt

|

13.

|

Morocco

|

20.

|

Thailand

|

|

7.

|

Hungary

|

14.

|

Peru

|

21.

|

Turkey

|

However “The Economist” also includes Hong Kong, Singapore and Saudi Arabia in the above list.

FTSE Emerging Markets: (www.ftse.com)

|

FTSE Advanced Emerging Countries:

|

|

1.

|

Brazil

|

3.

|

Mexico

|

5.

|

South Africa

|

|

2.

|

Hungary

|

4.

|

Poland

|

6.

|

Taiwan

|

|

FTSE Secondary Emerging Countries

|

|

1.

|

Chile

|

7.

|

Indonesia

|

13.

|

Russia

|

|

2.

|

China

|

8.

|

Malaysia

|

14.

|

Thailand

|

|

3.

|

Colombia

|

9.

|

Morocco

|

15.

|

Turkey

|

|

4.

|

Czech Republic

|

10.

|

Pakistan

|

16.

|

UAE

|

|

5.

|

Egypt

|

11.

|

Peru

|

|

6.

|

India

|

12.

|

Philippines

|

Banking System

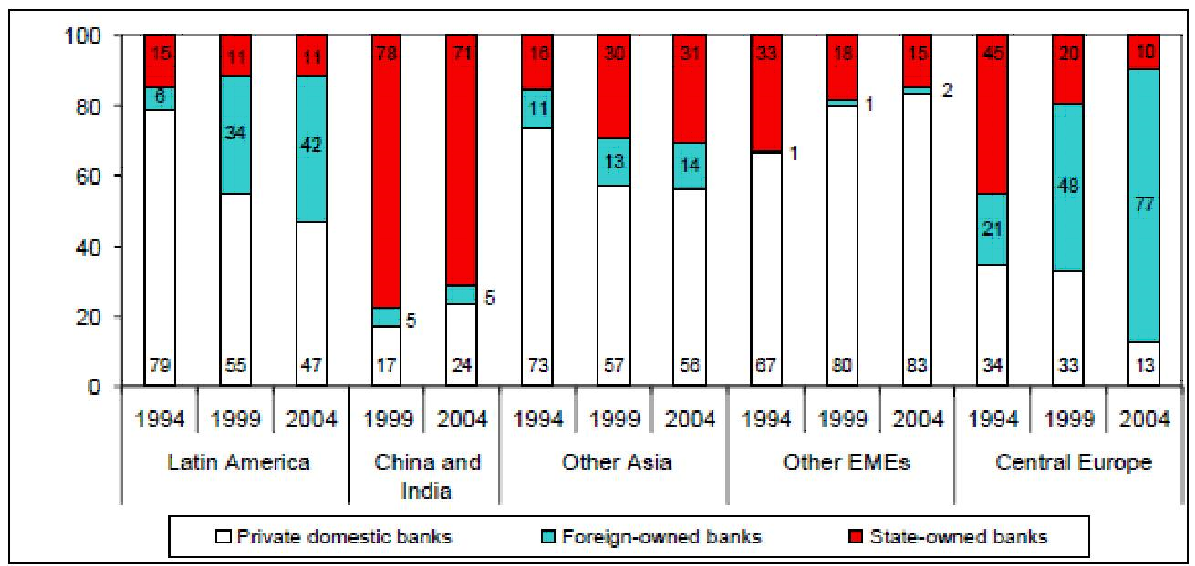

Commercial Banks are the main source of saving and funding in all emerging markets. These commercial banks are regulated by central banks of the respective countries. These commercial banks are either owned by govement or private (Domestic and Foreign). There has been huge amount of literature on the pros and cons of both the methodology.

Ownership in Commercial Banks Share in Total Bank Credit (IN Percentage) ![Share in Total Bank Credit (IN Percentage)]()

However only commercial banking system cannot meet the fund requirement of these economies and they have looked for alteative sources for fund sourcing purpose.

Foreign Investment in Emerging Markets

Foreign Banks’ investments in Emerging markets have increased substantially in the second half of 1990s. In Easte

Europe, banking assets under foreign control jumped from 25% in 1995 to 30% by 2000. Similarly in Latin America, around 40% of the banking assets were under control of Foreign Banks by 2000. It also saw a slew of cross border mergers and acquisition during the 2000 period. However, the similar scenes were not repeated in Asian markets. The share of banking assets under foreign control was around 5% in 1995 which increased to 6% by 2000. There were countries like Indonesia, Korea and Thailand who allowed foreign control in the banking system to the extent of 100 %. Philippines also allowed 60 % ownership by foreign entities in its banking system. (Song, 2004)

Countries has gone up significantly. The best way for fund sourcing is opening the economy for Foreign Direct Investment (FDI). As these economies are growing at a very rapid pace and foreign entities are interested in putting their money in, the emerging markets have opened their banking system too and have allowed foreign banks to open their branches in the local market.

This has led to higher competition, sufficient credit flow and better services to the public.

Foreign Banks in Local Market: Operational Strategy

Globalization has given birth to Financial Liberalization. Due to this, Foreign Banks have continuously played a significant role in the credit system of the emerging countries. These banks lend to the emerging economies either directly from their head offices or their local branches (Associate / Affiliate). “Follow the Customer” hypothesis (Grubel, 1977), requires bank to go and explore new markets for achieving the required growth and expansion. As the developed economies are getting stagnated in terms of growth and opportunity, foreign banks are entering new geographies to expand their size and business.

This foreign flow has merits and demerits of its own. As an emerging economy, the country always stays in needs of funds which are mitigated by the foreign banks. They bring innovative products, technology and better service facility. However they link the local economy to the global economy as can be seen from the recent economic crisis. As the developed economies ran short of funds or liquidity, foreign banks and investor started pulling back their money giving financial and macro economic shocks to these emerging markets.

The foreign banks enter the new country either through branch / subsidiary model or through joint venture model. Operation through branch is the most effective method as the bank can leaand understand the local market directly and also can leverage its key skills to compete in the market. The foreign banks come with low cost of funds as they have footprints in many other countries, and they can borrow money from low interest rate markets to high interest markets. It gives them an arbitrage opportunity. As they provide various financial instruments in different countries, the currency risk is automatically hedged.

The operation of foreign bank in a local market exposes the bank to various risks such as country risk, corporation risk, currency risk etc.

Pros and Cons of Foreign Bank presence in Local Market:

Advantages:

- Foreign Banks are more efficient because of their global presence and experience

- They can bring new innovative product

- They can bring new innovative product

- Better Management (Tigran Poghosyan, 2007)

- At times foreign bank supports the gove

ment in maintaining balance of payment and bringing stability in the domestic market

- Foreign banks bring more competition which is always good for a growing economy

- Better placed to serve multinational companies due to their geographic presence

- Lower cost of funds

Disadvantages:

- Domestic player may not be able to compete and in the process might become obsolete

- Coupling with global economy has its own perils

- Currency may become volatile if not managed properly

- Foreign banks mostly open their branches or subsidiaries in the financial hubs of the host countries, hence they do not serve majorly in the financial inclusion process of the local country

Foreign Bank Involvement in the Local Market and Change in Role

Foreign banks have been lending to the domestic market through its domestic affiliates since 1990s. The investment amount has been growing continuously as well as the involved number of players.

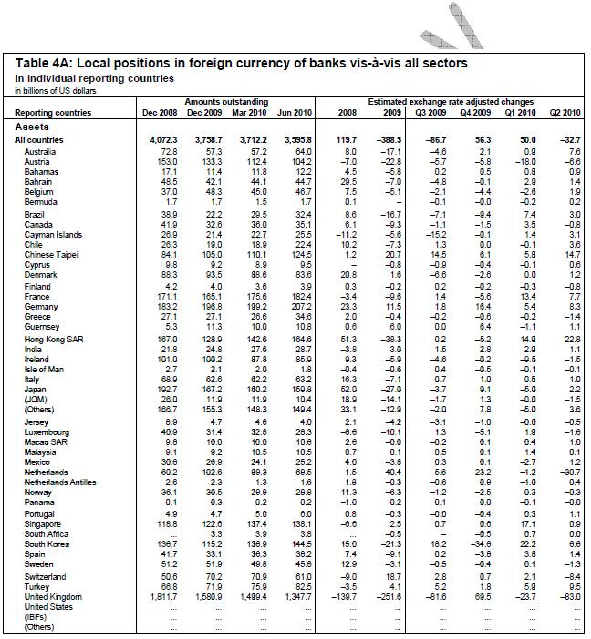

BIS reporting Bank’s foreign claims on emerging markets:

Assets![local positions in foreign currency of banks vis-a-vis all sectors]()

Liabilities

Emerging markets, its size and the risk are changing since 1990s at a very rapid pace, which have heighted the competition in the domestic market and they have to invent new strategies to compete with foreign banks. The foreign banks have gained good amount of experience in these territories and they are playing a bigger role in the macro economic development of the host countries. They are no more looked as an institution available to facilitate cross border transactions.

Earlier, foreign banks were happy to co-operate only the inteational players in their growth and expansion strategies, but as the market size has grown and local players are getting bigger and bigger, foreign banks are also participating in these companies growth story. (R.A. Brearley,1996)

Foreign banks also have become aggressive in their approach to these emerging economies. These countries have a very high GDP rate and they provide high retu

opportunity to the foreign investors. There are instances where foreign banks have acquired the local banks to increase their share of the market and support their organic growth strategy with inorganic growth.

Regulatory Development and Issues

Given the competitive advantage of foreign banks, as it operates in various countries and have a bigger portfolio, the local banks generally do not have sufficient weapons to compete with them. Also, the entry of foreign banks have some inherent problems such as coupling the local economy with global economy and putting pressure on local currency. Hence there is a requirement of stricter regulation to control these possible abruptions.

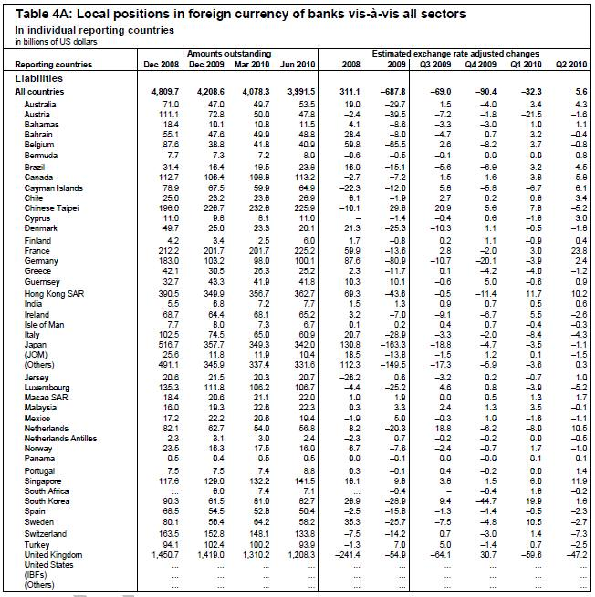

From an investment point of view, we can classify foreign investments into three categories:

- Banks having global presence

- Banks having presence in selective geography (Continent)

- Other players such as Private Equity, Venture Capital and Other Funds (Sovereign, Pension, etc.)

![capital in flows to emering europe]()

The increased presence of these entities in local banking system has demanded effective and efficient supervisory and regulatory bodies. (Song, 2004) The regulatory authority has mainly emphasized on collecting all the information of cross border transactions. As the economies are developing, and they are leaing from experiences, there are instances of mismanagement. But they are modifying the regulatory framework and keeping a check on all possible negative events. One of the examples of such mishap is the failure of “Bank of Credit & Commerce Inteational”, 1991. (Song, 2004)

Taxation is one of the major issues which comes with globalization. Most of the countries have developed trade agreements and tax treating to avoid such events.

Basel Committee, Inteational Monetary Fund and World Bank are continuously supporting and keeping a check over the banking systems by providing advisory services, funding and information.

Emerging markets have consolidated their regulatory system for effective and efficient banking system in the country. There are also organizations like AML and CFT which fights against terrorism financing.

Going forward, we will see major developments as the size of the economy grows and they open their economy completely for foreign participation.

Banking Environment

As per a recent World Bank report, Emerging Economies will outgrow the developed countries by 2015. Majority of the population in the emerging markets remain in the rural area and they have a sizeable bottom of the pyramid (Untapped Market) along with a younger working population. As the economy is growing,so is the financial independence and surplus income for these untapped markets. They are gradually playing a bigger role in the financial system and requiring banking services. Hence, the Foreign Banks have a major role to play and bigger mass to serve, which can be explored for higher returns.

Let us delve into some changes in the banking and financial industry in emerging economies:

Consolidation of the Financial Industry

The primary methodology for consolidation used by companies is through merger and acquisitions. There have been significant cases of local banks merging with another local or foreign entity:

Following are few examples of banking M&A – Both acquirer and target were listed in Asian or Latin American emerging markets 1998-2005 (JEL Classifications), (Giovanni, 2005)

|

11/11/1999

|

Target

|

Solidbank Corp

|

Philippines

|

|

Acquirer

|

Metrobank

|

Philippines

|

|

12/23/1999

|

Target

|

Bank of the Philippine Islands

|

Philippines

|

|

Acquirer

|

DBS Bank

|

Singapore

|

|

1/20/2000

|

Target

|

Siam Industrial Credit Co

|

Thailand

|

|

Acquirer

|

Siam Commercial BanK

|

Thailand

|

|

7/23/2001

|

Target

|

Utama Banking Group

|

Malaysia

|

|

Acquirer

|

Rashid Hussain

|

Malaysia

|

|

8/8/2001

|

Target

|

Banco De A Edwards SA

|

Chile

|

|

Acquirer

|

Banco de Chile

|

Chile

|

|

2/18/2002

|

Target

|

Banco de Credito del Peru

|

Peru

|

|

Acquirer

|

Credicorp Ltd.

|

Bermuda

|

|

1/28/2003

|

Target

|

United Overseas Insurance

|

Singapore

|

|

Acquirer

|

UOB

|

Singapore

|

|

11/11/2003

|

Target

|

Utama Merchant Bank

|

Malaysia

|

|

Acquirer

|

MIDF

|

Malaysia

|

|

2/24/2004

|

Target

|

Great Eastern Holdings

|

Singapore

|

|

Acquirer

|

OCBC

|

Singapore

|

|

3/22/2004

|

Target

|

Bank NISP Tbk PT

|

Indonesia

|

|

Acquirer

|

OCBC

|

Singapore

|

|

4/6/2004

|

Target

|

Bank Buana Indonesia

|

Indonesia

|

|

Acquirer

|

UOB

|

Singapore

|

|

5/12/2004

|

Target

|

Bank of Asia PCL

|

Thailand

|

|

Acquirer

|

UOB

|

Singapore

|

|

9/10/2004

|

Target

|

LG Investment & Securities

|

Korea

|

|

Acquirer

|

Woori Finance Holdings

|

Korea

|

|

2/18/2005

|

Target

|

Financiera Nacional Y Suramericana SA

|

Colombia

|

|

Acquirer

|

Bancolombia SA

|

Colombia

|

|

3/29/2005

|

Target

|

Bank NISP Tbk PT

|

Indonesia

|

|

Acquirer

|

OCBC

|

Singapore

|

|

4/27/2005

|

Target

|

Bank Niaga Tbk PT

|

Indonesia

|

|

Acquirer

|

Commerce Asset-Holdings

|

Malaysia

|

As these mergers and acquisition often require some changes in the existing regulatory frameworks, government has many a times made the required changes and supported the deals. The consolidation is also happening within the financial industry where various verticals of the banking system are merging with each other to become large full-fledged banking organization providing all the services under one umbrella.

Globalization

1996, Japanese government brought various financial reforms in the country. This was the time when Asian markets entered the globalization movement. As more and more players started exploring new geographies, local players also started innovating and restructuring the traditional system. In the current scenario, we are living in a technologically advanced world, where information is available freely and profoundly. The local players have studied the business model of foreign banks and hence they are able to replicate the methodologies and being up to date with the market.

Foreign banks need to continuously innovate and leverage their global presence to be successful and continue to grow in the coming days.

Crisis and its effects

When we talk about financial crisis, the first instance which comes to our mind is the 1929 crisis. However, the current financial crisis can also be compared with the prior as it has already left a serious mark in the world financial history. In such crises, it becomes difficult for the local as well as global financial authorities to manage the banking and financial system world-wide and locally. Many of the governments have shifted to deregulation of the financial industry and have given huge amount of funds in private hands. It brings positives and equal if not more negatives along with it, as the funds can be used for speculation, manipulating the markets and increasing volatility.

1990 onwards, we have seen various crises in different parts of the world such as Argentina Crisis, Russian Crisis, Brazilian Crisis, Asian Crisis and current crisis starting from America and leading to all the parts of the world. The asset quality has depleted, government has intervened and rescued various enterprises. All these incidents, tells us the importance of proper financial system and regulation.

There also has been instances of various scams and occurence of bubbles, such as the internet boom and bubble in the beginning of 21st century. In the globalized world, it also has been difficult to predict any such crisis situation and figuring out proper mechanism to come out of the same.

Foreign Banks Trends

Foreign banks play a significant role in the growth of the host country. Following are few trends seen in their investments:

- They are one of the major component for the economic growth of the country

- They also contribute in large for the reform of the financial sector in poor countries

- Globalization has been the cause for financial integration, foreign banks are the facilitators

- They are linking their business to common language and improving proximity to the borrowers

Following is the data for Total Number of banks and their asset size in various geographies:

|

Number of Banks

|

Assets of Banks (Billion US $)

|

|

1995

|

200

|

2006

|

1995

|

200

|

2006

|

|

Income

|

|

Low Income

|

442

|

523

|

526

|

126

|

199

|

848

|

|

Domestic Banks

|

358

|

385

|

366

|

118

|

179

|

779

|

|

Foreign Banks

|

84

|

138

|

160

|

7.6

|

20

|

69

|

|

Lower Middle Income

|

933

|

996

|

921

|

979

|

1410

|

4965

|

|

Domestic Banks

|

752

|

706

|

559

|

933

|

1260

|

4600

|

|

Foreign Banks

|

181

|

290

|

362

|

46

|

150

|

365

|

|

Upper Middle Income

|

1136

|

1130

|

937

|

448

|

1114

|

2413

|

|

Domestic Banks

|

834

|

738

|

562

|

345

|

786

|

1600

|

|

Foreign Banks

|

302

|

392

|

375

|

103

|

328

|

813

|

|

Region

|

|

East Asia and Pacific

|

275

|

287

|

281

|

551

|

868

|

4115

|

|

Domestic Banks

|

224

|

227

|

220

|

511

|

824

|

4010

|

|

Foreign Banks

|

51

|

60

|

61

|

40

|

44

|

105

|

|

Europe and Central Asia

|

743

|

813

|

747

|

172

|

429

|

1331

|

|

Domestic Banks

|

622

|

571

|

417

|

131

|

316

|

803

|

|

Foreign Banks

|

121

|

242

|

330

|

41

|

113

|

528

|

|

Latin America and Caribbean

|

863

|

840

|

663

|

531

|

925

|

1288

|

|

Domestic Banks

|

608

|

519

|

390

|

474

|

634

|

811

|

|

Foreign Banks

|

255

|

321

|

273

|

57

|

291

|

477

|

|

Middle East and Northern

|

|

Africa

|

170

|

169

|

164

|

159

|

279

|

372

|

|

Domestic Banks

|

135

|

126

|

106

|

149

|

251

|

315

|

|

Foreign Banks

|

35

|

43

|

58

|

10.5

|

28

|

57

|

|

South Asia

|

141

|

156

|

160

|

100

|

165

|

748

|

|

Domestic Banks

|

133

|

144

|

144

|

99

|

157

|

702

|

|

Foreign Banks

|

8

|

12

|

16

|

0

|

8

|

46

|

|

Sub-Saharan Africa

|

319

|

384

|

369

|

39

|

57

|

371

|

|

Domestic Banks

|

222

|

242

|

210

|

31

|

42

|

337

|

|

Foreign Banks

|

97

|

142

|

159

|

8

|

14

|

34

|

|

Aggregated Data

|

|

Total Banks

|

2511

|

2649

|

2384

|

1552

|

2723

|

8225

|

|

Domestic Banks

|

1944

|

1829

|

1487

|

1395

|

2224

|

6978

|

|

Foreign Banks

|

567

|

820

|

897

|

157

|

498

|

1247

|

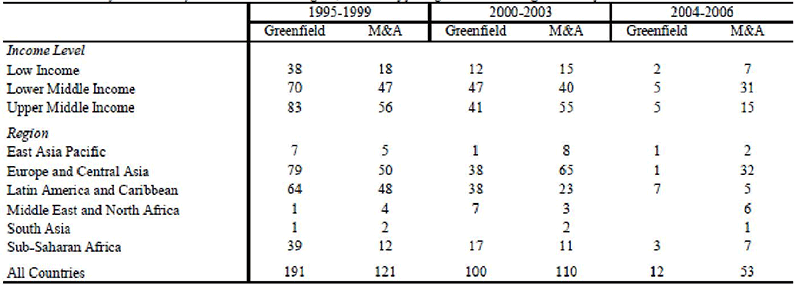

Following is the data for mode of entry of foreign banks in the host country (Greenfields or M&A)

![Data-for-mode-of-entry-of-foreign-banks]()

Following is the data for such share of such entries:

Foreign Banks: Learning from the past

Foreign banks have grown in size and role in the emerging countries. However there are still restrictions on the services offering, merger and acquisition and various other points which hinders the growth of foreign banks. China had promised WTO, that it will allow foreign bank to provide products and services without any restrictions, however it has never acted on the same, and it still is a closely monitored economy without letting the outer world know its policies and banking information. (Bostjan Jazbec, 2007) . Similarly, India has not allowed foreign banks to freely participate in its banking sector and there are restrictions on the number of branches to be opened annually by Foreign Banks in its territory.

Government has liberalized the capital markets to attract foreign capital and funds for the growth of the economy and sustaining GDP growth rate. Foreign funds invest in emerging income in search of higher returns compared to domestic country. Foreign banks earn arbitrage on the basis of interest rate parity. It’s a win-win situation for all the participants. Government has also supported the local banks by infusing huge amount of capital to make it more competitive with the foreign players. We can take example of Russia and India where the traditional banks are more competitive to foreign banks in terms of size and profitability.

The foreign banks have entered the domestic market through a green field investment or acquiring a domestic bank. Domestic bank acquisition has given immediate reach and understanding of local culture to the foreign entity. (Maria Lehner, 2006)

The Future of Banking

The economies have recovered from the crisis, and it is the time for consolidation. The governments are looking at their policies and regulations to find out flaws and answers to such crisis in future. Following are some developments that we can expect in future for the banking industry: (Douglas W. Arner, 2010)

- The developed economies will not persist with low interest rates. The emerging economies are in a dilemma between growth and controlling inflation. Currency war will continue as emerging markets are majorly driven by exports, where as developing countries are driven by consumption.

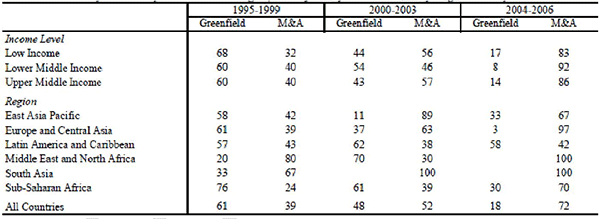

10 Year Yield Data:

Source: Datastream; Oliver Wyman analysi

- Consumers have shifted to more on savings and less on spending. This trend in developed economy will encourage more foreign banks to enter emerging economies as the growth rate for consumption driven economies will further decline

- Regulation in most of the markets will stricter and stringent hereon to combat future crisis like situations. It will have a positive impact on the transparency of the global banking system

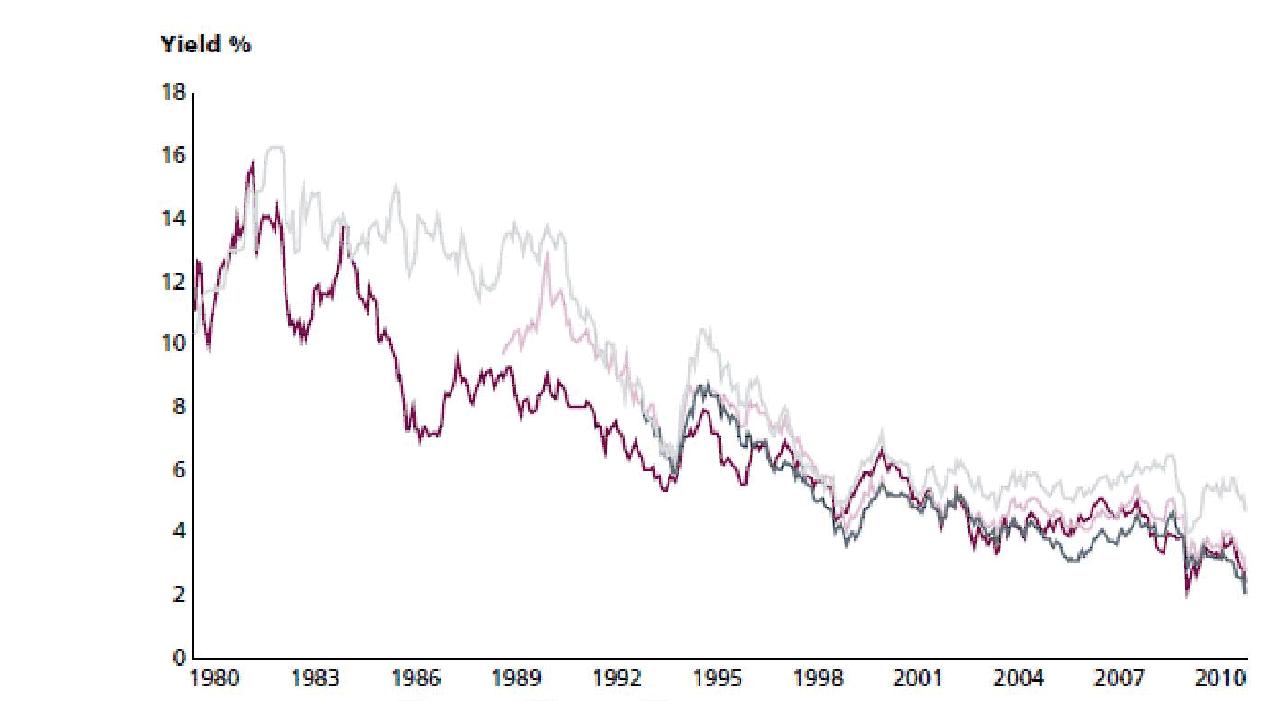

- Developing countries have younger population compared to developed countries; hence, the growth is here to stay with the emerging markets.

![Population by age group]()

- The rating of foreign countries might come down after the crisis. Hence the required rate of return for foreign investors might be higher in the coming years

The future of the world financial economy is with the emerging markets. The foreign banks will play a significant role in the growth of these economies not only with borrowing and lending activities but also with monetary policy of central bank and the government.

Cite This Work

To export a reference to this article please select a referencing stye below: