1. Modern management accounting tools

While some accountants have described modern management accounting tools and technology as laudable innovations essential for the survival of any organisation in a global competitive business environment (see Johnson, 1994; Hoque and Alam, 1999), others have argued that some of the so called modern management accounting tools and technology are just ‘old wine in new bottles’ (see Ezzamel, 1994; Norreklit, 2003).

Required:

Critically examine the above statements by analysing the argument for and against the development and implementation of modern management accounting tools and technology and evaluating the role of the management accountant therein.

In the contemporary business scenario, Managerial accounting is backbone for the any types and forms of organizations irrespective of its size or members. Modern accounting management has innovated the managerial accounting that plays important role in planning and controlling the cost objectives in order to make decision making more effective (Gray et al. 2010). Although most of authors does not agree with that fact that, management accounting is just form of accounting which is very much limited and has less transparency that could helps them to meet the organisational goals. However, while defending the above thought, the study will highlight the managerial tolls and techniques that will give enough scope for the management to survive in the long run (Bragg, 2001). Apart from that study will also features role of management accountant in shaping up the company internal management effectively by reducing the excessive cost and risk involve within the project.

Modern management accounting tools are very much helpful any organization in order to survive them in long run. Most of the large and small manufacturing industries are very much concern about their decision making which purely based on the profit and cost incurred (Bragg and Roehl-Anderson, 2011). Management accounting is very much backbone of every manufacturing business irrespective of its size or the volume.

Management accounting has been developed in year 1880 and thereby it has been changed since then as per the changing business environment. During the time of 1980 to 1990 efforts are being made to change the modern way of practicing the management accounting that has brought revolution in the system. In today, competitive business environment every business is catering global customer, therefore, companies tries to reduce their manufacturing with quality to gain the maximum customer satisfaction (Horngren et al. 2006). Apart from that, advance management accounting has various methods and tool suitable for each type of firms as per their efficiency and scale. Thus, it has been said that, managerial accounting is eyes and ears of the management. With the help of management accounting tools and technology the study will be further discussed:

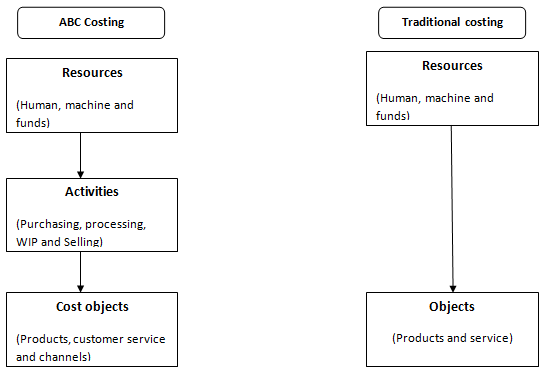

As noted by Chua and Poullaos (1998), although there are numerous methods the cost accounting but activity based costing is one of the most prominent methods of costing. It is used in the most of the international companies like McDonalds, Tesco and IBM. Some of the other major costing techniques are standard costing, absorption costing, marginal costing and historical costing. Activity based of costing is very much based on the activities while manufacturing the products (Horngren et al. 2006). The activities will decide the actual cost that could be distributed in fixed and variable costing.

1.1 Activity based costing

Activity based costing is better than traditional costing as because it is gather the entire costing information of single manufacturing task in one irrespective of their category such as labour or materials (Bragg and Roehl-Anderson, 2011). Activity based costing is very much based on the activities for instance the production of Coca Cola which would be based on the several activities like filing of up the bottle, quality check, moving the pallets of bottle and final products by sealing. With the help of these activities amount of labour , materials and the time are being calculated in order to fix price of the products.

Figure 1: ABC costing process

(Source: Bragg, 2001, pp-22)

One of the major advantages of this approach is that management can assess the task as per activities level make the budge as per their task. This will help the organization to segregate the high and low cost of the production on the basis of activities and task. Activity costing reduces the inaccuracy and chances of error is less because company trace direct labour and direct material cost (Maines and McDaniel, 2009).

However, one of the major drawback of the ABC costing is that it is very much difficult identify the overall costing and along with that it is not very much suitable for the small organization because of it support normally the batch run production function.

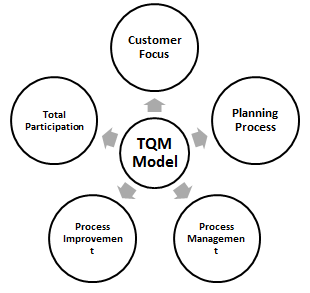

Total quality management is approach which was established in the 1951 and has been originally known for continuous effort to reduce the cost of the organizations. IT is technology which has been evolved and now it has become one of the important parts of development of the quality control within the manufacturing (Johnson, 1994). It helps the manufacturing companies to create the high quality products with low cost. the TQM has makes the management to resolve the quality issues like manufacturing defect, machine error and slow run of machine etc .

Figure 2: TQM model

(Source: Hoque and Alam, 1999, pp-200)

One of the major benefit of the TQM is to strengthen the competitive position of the company by reducing the waste and increasing the consistency within the production. It increase the higher productivity, for instance Companies like Wal-Mart are using the TQM within their company to reduce the waste and bring quality enhancement along with company has been bale to bring the customized products which is why Wal-Mart has become global leader in retail chain (Hoque and Alam, 1999).

However, TQM has been recently been overshadowed by the various in new innovations like Six sigma, lean management and Price 2 methodology are one of the most prominent global method of reducing the cost. Besides that , it reduces the innovations because it is more focused on consistency in the production.

Target costing is another major method of management accounting that is totally based on pricing method. It is one of the effective method of reducing by and large cost of the of products during its life cycle.

1.2 Total quality management

Target costing = target cost assumption – desired profit margin

Target costing plays important role in management accounting to design the phase in such way that continuous monitrioing of the p product manufacturing the moment it enter in the processing (Ezzamel, 1994). It is one of the tools that helps the companies like Heinz and Maggi achieve the consistent profitability in manufacturing. Some of the major process of t5atget costing are based on the primary research where the company first review the market cost of products, then form a team to make feature of products and set a price of the products which lesser than market price (Cooper, 2010). Moreover, Heinz used techniques of low costing by reducing one of the features from its tomato sauce products to sell their proudest in Asian market.

Besides that , company also take care of the engineering of product by proportionate the component of the products which is of high quality, delivery and with high quantity levels (Faulkender and Petersen, 2009). However, target costing is very much has lesser application in the labour intensive manufacturing.

Figure 3: Three major elements of target based costing

(Source: Faulkender and Petersen, 2009, pp-47)

Another major technique of management accounting is benchmarking which helps to set the standard time for every task for the labour and machinery while producing (Lee et al. 2011). After the overall finished products have been produced then the actual cost and benchmarking will be compared so that actual difference so that difference must be analyses.

Benchmarking tool is a process to measure the cost of production or rather profitability of the own company with existing competitors. Benchmarking tool helps to bring the healthy competition among the companies to measure the quality, time and cost during the time of production of the products (Weiss et al. 2008). Here the best benchmarking firm will have a competitive edge to produce more with low selling price.

Some of the major bench marking methodology is given below:

Here the company will be conducting research for failure of its products or services on low sale. This can be possible techniques like taking feedback from the customers and collecting the qualitative and quantitative research to re –engineer the products (Winklhofer and Diamantopoulos, 2008). While doing so company will also review its manufacturing process and cycle time.

Finding solution from the similar industries: Looking for the solution from the competitors who are already has high market share in the market. During the time of doing so, competitors techniques and tools must be taken consideration in order to assess its current way of production functions (Schroeter, 2009).

Following the leaders methods : After assessing the current production function with competitors. Company should follow the leaders who are using same techniques o or different technique during the time of production. Then study company current process within its annual report, or magazines or from its suppler to improve its own techniques be learning from the leader.

Implement innovative business practices: And finally implement the leading edge technology or methods of production in order to increase its efficiency and reduce the price of the products to sustain in the current market (Cgma.org, 2015). Benchmarking helps the organization o to create opportunities for the companies to compete with the existing companies in the same sector.

1.3 Target costing

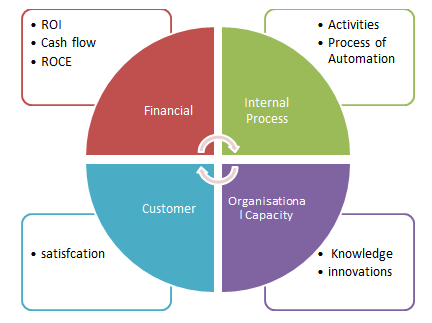

Balance score card is one of the major way monitoring ion the performance of the company. Balance score helps the company and management specifically management accountant to assess the efficiency of the machine and labour in compare with investment made (Nørreklit 2003). Balance score is very much base on the financial, customer and innovations and internal analysis of the company.

Figure 4: Balanced score card

(Source: Smith et al. 2008, pp-198)

Balance score card helps to company work as per visions and strategy of the company in the long run. Balance score card comprises of the financial perspective, internal perspective, organizational capacity and finally customer perspective (Cgma.org, 2015). One of the major advantages of the balance score card is the major it helps in improving the process and motivates the employees to work towards the organizational goals. It specifically monitors the progress of the employees by analyzing the customer satisfaction process to increase its financial profitability.

Internal perspective: Internal perspective is very much related to the company visions which customise the product as per the customer demand. Manager need to focus on the critical operation of the company in order satisfy the consumer needs (Ezzamel, 1994).

Organizational capacity: This is related to the organizational efficiency and innovations perspective. Companies like IBM and SAP ERP are some of the company that uses the balance score card to understand their innovation capacity (Nørreklit 2003).

Customer perspective: By collecting the data from the customer base in order to understand that customer are happy with the products and services as per their demand or not. Customer feedback on the product s and services data gives the manager to re-engineer or innovating the products in order to satisfy the customers.

Financial perspective: At this phase the time and collection of data is been always be given the top priority and manager will provide the necessary financial requirement to analyze the financial information (Lee et al. 2011).

It is another most important technique of analyzing the actual cost of production. Value chain analysis is based value given at each and every stage of production or processing starting from procurement to finished products.

Figure 5: Value chain analysis

(Source: Weiss et al. 2008, pp-1102)

One of the major benefit of value chain analysis plays important role in developing the high value for the customers in business. The tool is used to analyses the activity , value chain and evaluation and planning (Schroeter, 2009).

Activity analysis: In this stage company need to identify the activities that helps to produce the goods and services.

Value analysis: Value chain analysis , adding value to each and every stage of production nd make the products of great value.

Evaluation and planning: lastly, while evaluating the plan assessing wheter it is possible for the changes and make plan for an action (Smith et al. 2008).

Profitability analysis based on the ratio. These ratios show the company actual capacity and its growth rate. Profitability analysis comprises of various sets of ratios that helps the company and investor to understand whether the company is being running profit or loss.

Apart from that profitability analysis helps the company and management accountant to understand the actual ROI and, operating profit by selling of products and services by the organizations (Smith et al. 2008). It is one of the major tools which indicate the company actual cash inflow and actual cash outflow.

Profitability analysis based on the comparing the own ratio with the same sector ratios in order to rationalize the actual financial position of the company in term of industry and competitors.

Customer competitive accounting is based on the three major techniques such as valuation of customer’s asset, lifetime customer profitability and customer profitability analysis (Johnson, 1994). Customer competitive accounting helps the companies to understand the value given to the customer are worth the penny or not.

Customer competitive accounting is based on the competition pricing set by the organizations. It comprise of the cost pricing strategy used by the companies to value worth of the products (Gu and Chen, 2009). Value pricing is another major method of the analyzing the customer competitive piercing that creates pricing based on the value of the products.

Customer competitive accounting is very much based on the customer choice of products and its price which has been changing in compete to its competitors.

One of the major roles of the management accountant is to manage and control the costing of the manufacturing unit by planning and budgeting for the organizations.

Figure 6: Role of management accountant

(Source: Schroeter, 2009, pp-7)

Management account takes report from the controller and treasurer in order maintain the record of each and every transactions. Management accountant uses planning, controlling and co-coordinating in shaping up the company internal cost.

Planning: While planning , management accountant plan the products on and set the mission of the company into sub goal for the every controller and treasurer (Gray et al. 2010). While planning the team is being formed to make sure the production runs smoothly.

Controlling: Here the manager checks the entire activities and monitoring the implementation of plan. While doing so company take feedback in order to achieve the correct information that can be help to implement the plan (Bragg and Roehl-Anderson, 2011).

Decision making: Finally while making the decision, management accountant analyses the alternatives in order to use the best suitable techniques of method or technology as per the company requirement.

Competence: It is very much based on the professional competence and prepare the clear and complete record as per the policy and procedures.

Confidentiality: Not disclosing the information to the third party before taking permission from the owners and board of director of the company. Maintain the confidentiality of the company in order to reduce the conflicts and maintain the trust (Bragg and Roehl-Anderson, 2011).

Integrity: While coming to the integrity, MA tries to solve the conflict by using the NO Blaming Policy within its management techniques (Johnson, 1994). Refuse any kind of floor, or money or rather incentives while making actions. This indicates no biasness towards any of the employees or any other members.

Objectivity: MA is solely responsible for the disclosing the required information to management. The communication must be fair and reasonable.

Conclusion

From the above, it has been found that management accounting is very much helpful for the organizations in any case to sustain in the long run. Management accounting techniques are very much helps to build the strong internal base for the organizations. With the help of various method of tools and techniques of the management accounting support the thought that describes it is eyes and ear of the organizations. ABC costing is very much based on the activities during the time of manufacturing process. Besides that, TQM is technology which helps to bring the quality within the products and service of the organization by reducing the waste and bring consistency within the productions. Finally, management accountant are very responsible for manage and control the internal financial system of the organizations by planning, control, decision making and by forming the team.

Reference List

Bragg, S. (2001). Cost accounting. New York: John Wiley.

Bragg, S. and Roehl-Anderson, J. (2011). The controller's function. Hoboken, N.J.: Wiley

Gray, R.H., Owen, D. and Maunders, K. (2010). Corporate Social Reporting, London: Prentice Hall

Horngren, C., Datar, S. and Foster, G. (2006). Cost accounting. Upper Saddle River, NJ: Pearson Prentice Hall.

Chua, W. and C. Poullaos (1998). The dynamics of 'closure' amidst the construction of market, profession, empire and nationhood: An historical analysis of an Australian accounting association, 1886-1903. Accounting, Organisations and Society, 23(2): 155-187.

Cooper, I. (2010) Asset pricing implications of nonconvex adjustment costs and irreversibility of investment, Journal of Finance 61, 139-170

Ezzamel, M., (1994), From problem solving to problematization, relevance revisited, Critical Perspectives on Accounting, Vol. 5, pp. 269-80.

Faulkender, M., and Petersen, M. A. (2009) Does the source of capital affect capital structure?, Review of Financial Studies 19, 45-79.

Gu, Z. and Chen, T. (2009) “Analysts’ Treatment of Nonrecurring Items in Street Earnings.” Journal of Accounting and Economics 38, 129 – 170.

Hoque, Z. and Alam, M. (1999), TQM adoption, institutionalism and changes in management accounting systems: a case study’, Accounting and Business Research, Vol. 29, no. 3, summer, pp. 199-210.

Johnson, H T., (1994), Relevance Regained, total quality management and the role of management accounting, Critical Perspectives on Accounting’, Vol. 5, pp. 259-67.

Kinney, M. and Trezevant, R. (2008) “The Use of Special Items to Manage Earnings and Perceptions” Journal of Financial Statement Analysis 3, 45-53.

Lee, C., Ng, D. and Swaminathan, B. (2011) Testing international asset pricing models using implied cost of capital, Journal of Financial and Quantitative Analysis, 73, 411-431.

Maines, L. and McDaniel, L. (2009) “Effects of Comprehensive-Income Characteristics on Nonprofessional Investors’ Judgments: The Role of Financial-Statement Presentation Format.” The Accounting Review 75, 179-207.

Nørreklit H. (2003) The Balanced Scorecard: what is the score? A rhetorical analysis of the Balanced Scorecard, Accounting, Organizations and Society, Volume 28, Issue 6, August 2003, pp. 591-619.

Schroeter, J. (2009) "Multiple Forecasting System at Brake Parts, Inc.," journal of Business Forecasting, pp. 5-9

Smith M., Abdhllah, Z. and Abdul Razak, R. (2008) The diffusion of technological and management accounting innovation: Malaysian evidence. Asian Review of Accounting, 16(3), pp. 197-218

Weiss, D., Naik, P.N. and Tsai, C.L. (2008) Extracting forward-looking information from security prices: A new approach. The Accounting Review, 83(4), 1101-1124.

Winklhofer, H. and Diamantopoulos, A. (2008) A model of export sales forecasting behavior and performance: development and testing International. Journal of Forecasting 19, 271–285

Cgma.org, (2015). Essential tools for management accountants - CGMA. [online] Available at: https://www.cgma.org/Resources/Tools/essential-tools/Pages/list.aspx?TestCookiesEnabled=redirect [Accessed 19 Mar. 2015].

To export a reference to this article please select a referencing stye below:

My Assignment Help. (2016). Critical Examination Of Modern Management Accounting Tools And Technology: An Essay.. Retrieved from https://myassignmenthelp.com/free-samples/modern-management-accounting-tools-and-technology.

"Critical Examination Of Modern Management Accounting Tools And Technology: An Essay.." My Assignment Help, 2016, https://myassignmenthelp.com/free-samples/modern-management-accounting-tools-and-technology.

My Assignment Help (2016) Critical Examination Of Modern Management Accounting Tools And Technology: An Essay. [Online]. Available from: https://myassignmenthelp.com/free-samples/modern-management-accounting-tools-and-technology

[Accessed 19 August 2024].

My Assignment Help. 'Critical Examination Of Modern Management Accounting Tools And Technology: An Essay.' (My Assignment Help, 2016) <https://myassignmenthelp.com/free-samples/modern-management-accounting-tools-and-technology> accessed 19 August 2024.

My Assignment Help. Critical Examination Of Modern Management Accounting Tools And Technology: An Essay. [Internet]. My Assignment Help. 2016 [cited 19 August 2024]. Available from: https://myassignmenthelp.com/free-samples/modern-management-accounting-tools-and-technology.